RELATED TOPICS: VUCA Environments | Business Continuity

Enterprise Risk Management

Since its foundation, SEED has built a robust team of risk experts grown from their individual practice with major industrial players and within major risk domains: regulation, analytics, governance, organisation, culture, process, and systems redesign. Our risk expertise integrates with our core competencies: strategy, decision-making support and operational planning, for senior & executive management.

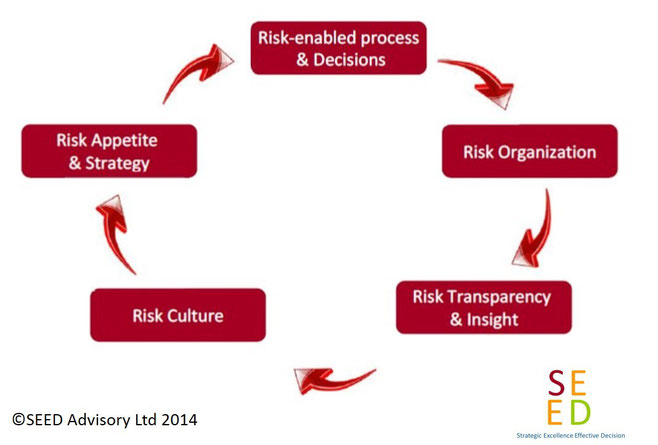

Our Risk Management practice has five main focus areas:

Our Risk Skills at your services

- Risk Appetite & Strategy: Understand risk factors within financial and strategic circumstances, to ensure risk choices align with corporate strategy and risk-taking capabilities. Definition of risk appetite, integrated management of risk and return;

- Risk-enabled process & Decisions: Integrate risk management into strategic-planning processes as well as into day-to-day operations and decision-making. Incident management & business continuity are part of this competence.

- Risk Organisation: Managing risk is the responsibility of the entire organisation. The right structural and organisational choices are critical to ensuring robust and effective enterprise risk management. Define the roles and responsibilities of corporate and business-unit-level risk functions and how they should interact with other parts of the organisation.

- Risk Transparency & Insight: Identify, quantify, and prioritise risks, and forward-looking risk reporting & risk disclosure supported by comprehensive data and robust IT solutions.

- Risk Culture: Mind-sets and behaviours play a crucial role in the execution of a company’s risk strategy. Clarify on specific cultural challenges within organisation and support in creating structured interventions to address these challenges. Providing Training & Coaching to empower risk culture and risk-aware behaviours.

Enterprise-wide Support

We link risk management and performance management with our risk-related services:

- Risk Assessment

- Control Effectiveness Testing

- Governance Requirement Impact Analysis

- Risk Management System Design

- Compliance Programs

- Internal Control Frameworks

- Customized Control Requirements Definition

- Internal Control Environment

- Policies and Procedures

- Standing Orders & Delegation of Power

- Roles & Responsibilities

- Authorization Matrices

- From project to Business-As-Usual Risk projects

- Controls embedded in ERP systems

- Quality & Compliance Requirements Integration

Managing Uncertainty

Do you integrate uncertainty?

A central challenge of Risk and Strategy in general is that we have to make choices now, but the payoffs occur in a future environment we cannot fully know or control. Rigorously understanding the uncertainty you face starts with listing the variables that would influence a strategic risk management decision and prioritising them according to their impact. Focus early analysis on removing as much uncertainty as you can. Then apply Risk & Compliance tools such as simulation and scenario analysis to the remaining, irreducible uncertainty, which should be at the heart of your Risk strategy.

Risk & Control Frameworks:

In the aftermath of compliance projects since 2005, the multiple Governance-Risk-Compliance (GRC) frameworks did not systematically prove to increase risk awareness and risk management effectiveness, according to recent studies. Most (market-)finance related frameworks assumes that company management is behaving as rational economic agent, using the risk - reward balance as metric. Based on recent findings however, managers do not behave as rational economic agents and companies still encounter difficulties to define their risk appetite.

Integrated Risk-Management:

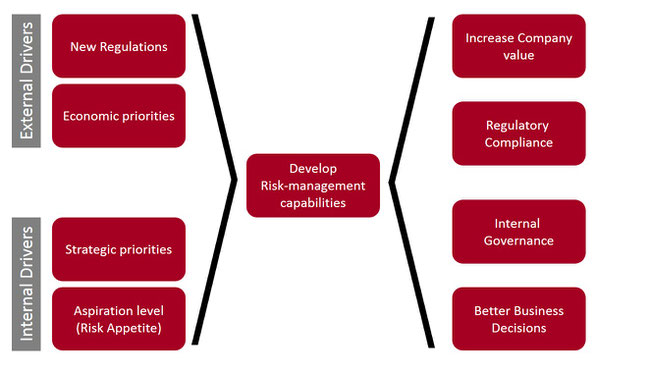

One possible option to bring more effectiveness is to use comprehensive integrated risk models as a key component of the organisation structure & culture. We help clients to design and implement integrated risk-management solutions - Enterprise Risk Management (ERM) - and bring a risk-reward perspective to strategic decision making: